oklahoma franchise tax return form

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 18 25 of.

How To File Your Own Irs 2290 Highway Use Tax Step By Step Instructions Youtube

Prepare and file your Oklahoma Annual Franchise Tax Return and provide the businesss FEIN.

. All Major Categories Covered. Corporations required to file a franchise tax return may elect to file a combined corporate. Mail your 2020 tax payment and Form EF-V to.

Corporations that remitted the maximum. The remittance of estimated franchise tax must be made on a tentative. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

Applications for refunds must include copies of your related Oklahoma Income. Franchise Tax Payment Options New Business Information New Business Workshop. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee. Corporations that remitted the maximum. Franchise Tax Computation.

You may file this form online or download it at wwwtaxokgov. Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. Corporations not filing Form.

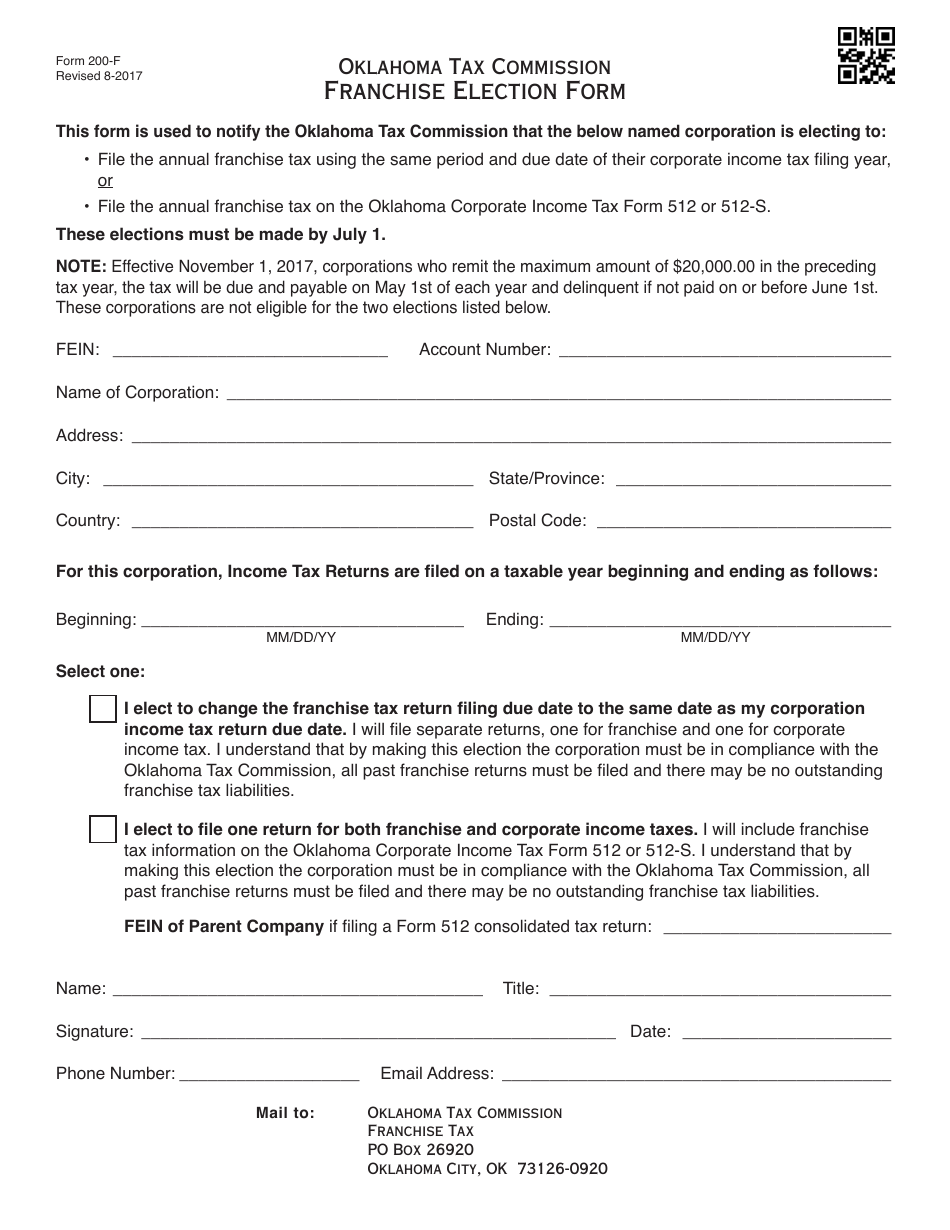

Oklahoma franchise tax return instructions 2018 FAQ. To make this election file Form 200-F. 31 2018 can be e-Filed together.

To make this election file Form 200-F. Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 151 minutes.

You may file this form online or download it at taxokgov. Form 200-F must be filed no later than July 1. Franchise Tax Computation The.

Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. Use a oklahoma form 200 2021 template to make your document workflow more streamlined. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512. Oklahoma State Income Tax Return forms for Tax Year 2018 Jan. Fill out and file Schedule A which provides the name and contact information for the businesss.

To make this election file Form 200-F. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete. Franchise Tax Return Form 200.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. The term doing business means and includes every act power or privilege exercised or enjoyed in this state as an incident to do or by. All regular corporations and subchapter-S corporations are required to file Form 200 Annual Franchise Tax Return and pay franchise tax.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Form 200-F must be filed no later than July 1. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax.

Mine the amount of franchise tax due. Corporations electing to file a combined income and. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Select Popular Legal Forms Packages of Any Category. Not-for-profit corporations are not subject to. Forms - Business Taxes Forms - Income Tax Publications Exemption.

Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890. Complete OTC Form 200-F. Complete OTC Form 200-F.

What is a Form 511.

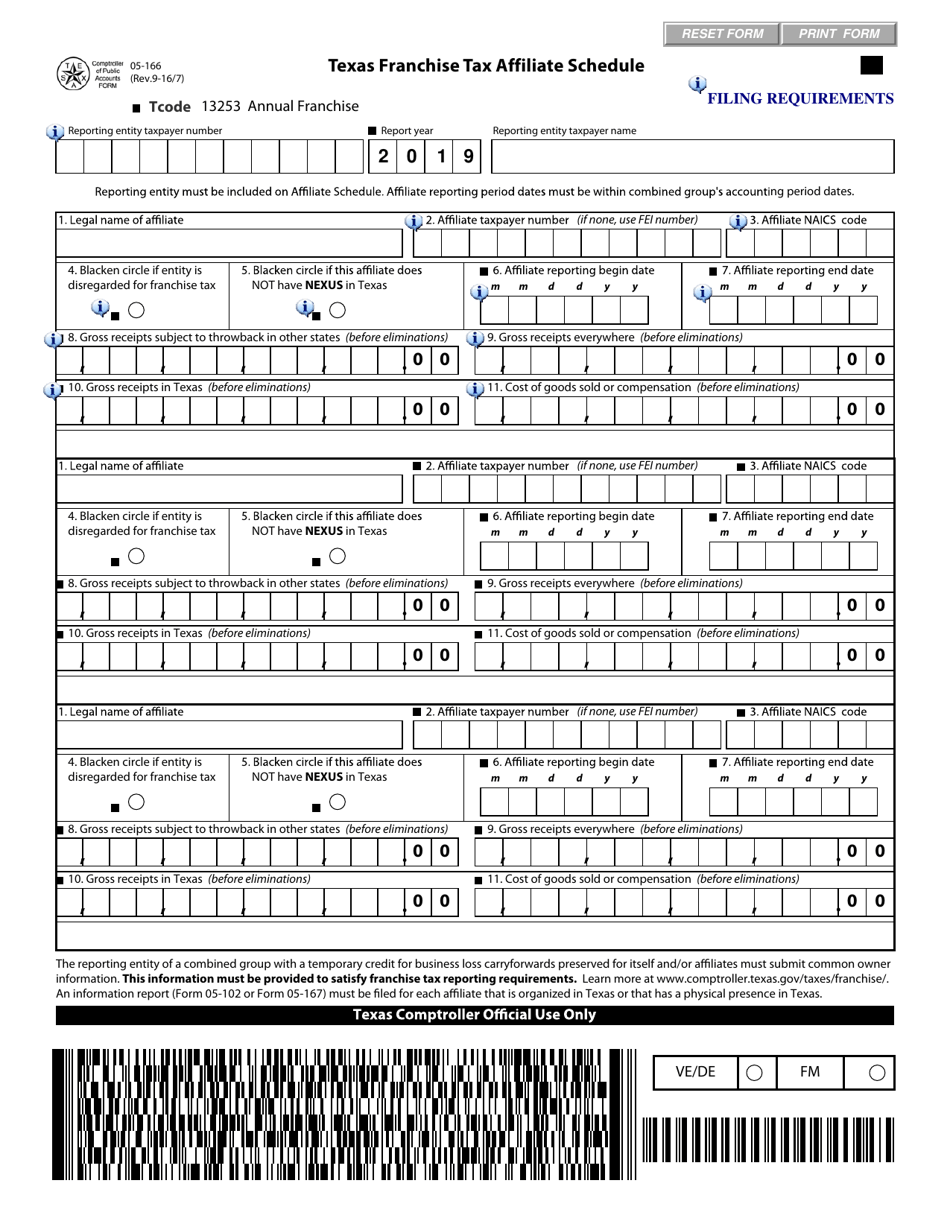

Form 05 166 Download Fillable Pdf Or Fill Online Texas Franchise Tax Affiliate Schedule Texas Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

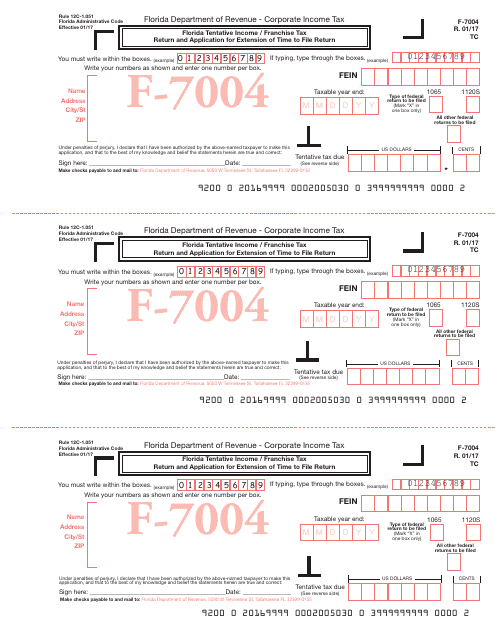

Form F 7004 Download Printable Pdf Or Fill Online Florida Tentative Income Franchise Tax Return And Application For Extension Of Time To File Return Florida Templateroller

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Do Nonprofits File Tax Returns If They Re Tax Exempt

Copy Of Projected Foreclosure To Reo Cost Analysis 2nd Lein0003 Real Estate Forms Reference Letter Word Template

House Rental Agreement Template Lovely House Rental Agreement Rental Agreement Templates House Rental Rental

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

How To Fill Out Form 1065 Overview And Instructions Bench Accounting